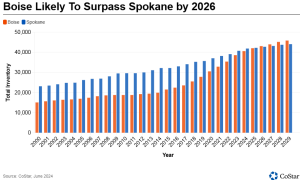

Around the turn of the century, Boise, Idaho, surpassed Spokane, Washington, as the largest metropolitan area in the Inland Northwest by population. After several years of solid growth, Boise may also soon become the largest apartment market in the Inland Northwest.

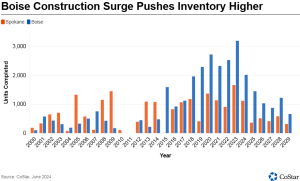

Over the past five years, Spokane has seen steady growth, adding an average of more than a thousand units annually. This represents an increase in construction velocity of nearly a third compared to the previous five years. Meanwhile, Boise saw more than 2,600 units added annually over the past five years, more than double the pace of construction from the previous five-year period.

With this acceleration, Boise’s apartment inventory has grown at double the speed of Spokane’s over the past 10 years, rapidly closing the gap between the two. While multifamily stock in the Spokane area saw an average increase of about 3% annually over the past 10 years, developers increased Boise’s inventory by an average of just over 7%.

That shift has been most dramatic since the start of 2020. Since then, developers have added more than 12,000 units to Boise’s inventory, a 44% increase. Spokane’s inventory grew by about 6,000 units, an increase of 17% over the same period.

The west side suburb of Meridian has been a focal point for apartment developers in Boise over much of the past decade and has held more than 40% of all new construction in the region since 2020. Developers have targeted central Meridian and the Pine Avenue and Interstate 84 corridors, where access to job nodes and amenities drives leasing.

Two examples of stabilized communities built in recent years include Entrata Farms and Olympus at Ten Mile. The communities are within walking distance of the developing Ten Mile Crossing, a 75-acre campus with office buildings and other uses that could include retail, restaurants, entertainment, shopping, consumer services and hotels. Nearby, The Aren, Seasons at Meridian, and Wesley Apartments comprise the bulk of units currently in the pipeline.

While construction activity is slowing in both markets given the difficulty of obtaining construction loans with favorable terms, Boise is still seeing elevated levels of activity. The 3,000 units under construction amount to an increase in inventory of nearly 8%. Spokane’s 1,200 units under construction amount to an inventory increase inventory of less than 3%.

Over a longer time frame, areas such as South Boise could pick up the construction slack once capital costs stabilize. Micron’s announcement that the semiconductor maker will build a sizeable memory fab facility off Interstate 84 near its current campus reflects a $15 billion endeavor that could create thousands of jobs in the region, increasing its demand for housing. Parts of South Boise are near Micron’s headquarters and have ample land available, making the locale a desirable candidate for developers looking to attract a growing employee and contractor base.

Spokane will undoubtedly remain a desirable region for relocation within the Pacific Northwest as well. Growth in east side areas such as Spokane Valley and synergy with Coeur d’Alene add plenty of appeal for businesses and residents alike.

However, megaprojects in Boise, like the Micron development, will likely drive further growth in manufacturing and tech. In turn, that expansion will likely accelerate job and wage growth, complementing more stable employment sectors such as government, given Boise’s presence as the state capital. These factors will keep the Boise metropolitan area on track to surpass Spokane, keeping it in the running to become the largest apartment market in the Inland Northwest region.