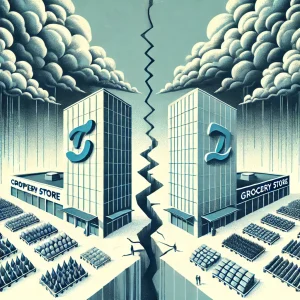

Kroger and Albertsons Merger Ends: What Happened and Why It Matters

The $24.6 billion merger between Kroger and Albertsons, two of the largest grocery store chains in the U.S., is officially over. After two years of planning, the deal fell apart due to legal issues, government concerns, and accusations between the two companies. This blog explains what happened, why it matters, and what might come next for both companies.

Albertsons Sues Kroger for $600 Million

One day after a federal judge stopped the merger, Albertsons filed a lawsuit against Kroger. Albertsons wants Kroger to pay $600 million in fees and billions more in damages.

Why? Albertsons claims Kroger didn’t do enough to get government approval for the deal. They say Kroger ignored regulators’ suggestions, refused to sell enough stores, and didn’t work with good buyers to solve antitrust concerns.

Kroger disagrees. In response, Kroger says Albertsons broke the agreement first. Kroger called the lawsuit unfair and said it worked hard to follow the deal. Both companies are now preparing to fight it out in court.

Why the Merger Was Blocked

The main reason the deal fell apart was because the government said it would hurt competition. The Federal Trade Commission (FTC) and a federal judge argued the deal would be bad for shoppers, leading to higher grocery prices.

Here are the key reasons:

- Too Much Power: The FTC said merging the two chains would create a grocery store monopoly, reducing competition. Shoppers already have fewer options as big players like Walmart, Amazon, Aldi, and Costco dominate the market.

- Store Sales (Divestitures): Kroger and Albertsons offered to sell 579 stores to a company called C&S Wholesale Grocers to avoid monopoly concerns. But the judge wasn’t convinced C&S could successfully run that many stores.

- Ignored Feedback: Albertsons claims Kroger didn’t listen to regulators when they asked for better solutions.

In the end, the judge decided the deal wasn’t fair for shoppers or smaller competitors.

What’s Next for Kroger and Albertsons?

Now that the merger is over, both companies need new plans. Here’s what might happen:

Albertsons

- Lawsuit Battle: Albertsons will focus on winning its lawsuit against Kroger and getting the $600 million breakup fee.

- Financial Stability: If Albertsons wins, it might use the money to buy back shares and improve its finances.

- Finding a New Buyer: Albertsons may look for a new partner or buyer to help it compete in the tough grocery market.

Kroger

- Shareholder Focus: Kroger will likely focus on growing its stock value and restarting share buybacks, which had stopped during the merger talks.

- Growth Plans: With a strong financial position, Kroger can work on improving its stores, lowering prices, and competing without needing a major merger.

Why This Matters for Shoppers

The collapse of the Kroger-Albertsons deal highlights how competitive the grocery market is today. While traditional grocery stores struggle, companies like Walmart, Amazon, and Aldi are growing quickly. Shoppers want low prices, fast delivery, and more choices, w hich puts pressure on stores like Kroger and Albertsons.

hich puts pressure on stores like Kroger and Albertsons.

Without the merger, Kroger and Albertsons will have to compete harder to win over customers. This could mean lower prices, better deals, and improved services as both chains work to stay ahead.

Conclusion: A Two-Year Saga Ends

The Kroger-Albertsons merger is officially over, and both companies are blaming each other. While Albertsons focuses on its lawsuit, Kroger will move forward on its own. The breakup shows just how hard it is for traditional grocery stores to compete in today’s market.

Shoppers and industry experts will be watching closely to see what happens next. Will Albertsons find a new buyer? Can Kroger grow without a major deal? Only time will tell.

Stay Updated

We’ll keep following this story and provide updates on the lawsuit and what comes next for Kroger and Albertsons. Stay tuned!