Multifamily leasing in Boise, Idaho, continues to show signs of strength heading into the historically busier summer months. Absorption, the difference between move-ins and move-outs, has subsequently rebounded, led by an active suburban renter base and complemented by several hot spots around the city’s urban core.

During the first quarter of 2024, combined demand in the nearby suburbs of Meridian, Caldwell and Nampa accounted for about two-thirds of the net change in occupied units in the Boise area. While denser urban locations such as north and downtown Boise made up a smaller share of overall demand, these areas witnessed a stronger acceleration in demand during the first quarter than their suburban counterparts. For example, north Boise saw 65 units absorbed, which runs 59% above its previous 10-year quarterly average. Meridian led suburban areas with 235 units absorbed in the first quarter, a 38% increase over the previous 10-year quarterly average.

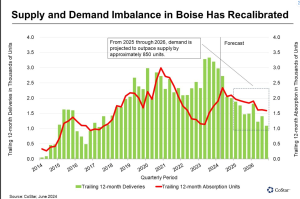

On a trailing 12-month basis, more than 2,300 units have been absorbed across the Boise metropolitan area, the highest mark since mid-2021. This upward velocity indicates that if leasing holds steady, 2024’s calendar year performance could comfortably surpass the area’s 10-year average mark of 1,570 units.

Additionally, single-family house pricing remains prohibitively expensive in the region. While the cost to purchase a residence isn’t perfectly correlated to the demand for multifamily housing, it remains a factor in the Boise metro that could further encourage leasing.

In the expensive west side suburb of Meridian, for example, current house listings on Homes.com show a solid sampling of single-family residences priced under $500,000. Still, some of those listings are not move-in-ready, and it is typical for residential property prices in Meridian to exceed $600,000. At current interest rates and a 20% down payment, the principal and interest payment alone on a $400,000 house amounts to more than $2,100 per month for a 30-year loan. By comparison, Boise’s market asking rent for a Class A apartment unit equates to $1,650 per month.

With affordability remaining an outsized factor in living options, incoming supply of new rental units could decline substantially in the next two years. There are 3,100 units underway as of the second quarter of 2024, but construction starts have nosedived since early 2022. The thinning multifamily pipeline suggests that steep financing costs and tight underwriting standards have taken a toll on construction activity, dragging it down to about a 47% drop from peak construction of 5,800 units in late 2022. As such, CoStar predicts that demand will outpace new supply by about 850 units during 2025 and 2026.

Strengthening demand in the form of leasing, coupled with slowing apartment completions, has halted the Boise market’s lengthy vacancy expansion and rent growth erosion. The vacancy rate of 11.3% has inched below its previous 10-year high of 11.5% in late 2023. CoStar’s daily asking rent series — which measures the change in daily asking rents for the sample of communities currently advertising units — has shown pronounced upward pressure since mid-December 2023. In response, year-over-year rent growth is forecast to return to the 4% range by the end of 2024.